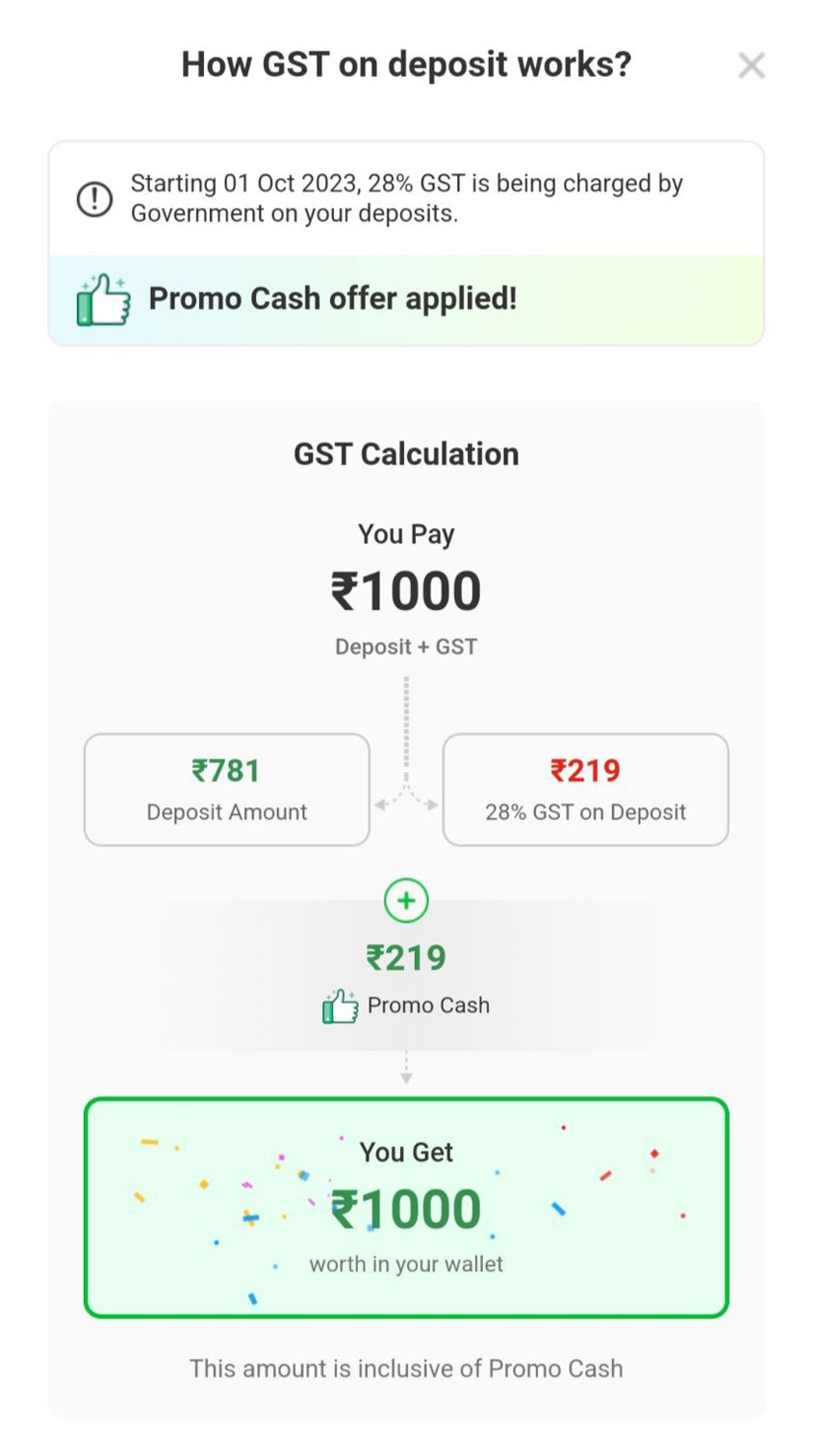

New Govt. Rule: Starting 1st Oct, 2023, 28% GST will apply on

deposits on Online Gaming platforms.

But don't worry✋ Play Rummy, Worry-Free!

Get Guaranteed Promo Cash on all Deposits!

- Promo Cash Calculation

- FAQs

About Promo Cash:

You can use your Promo Cash balance to play Cash Games and tournaments. Let's understand this better with scenarios.

Scenario 1 (Pool & Deals Rummy & Tournaments)

Let's say Mr. Rao uses ₹ 200 from his Promo Cash balance to play games & wins ₹ 1000.

| Case A: Game Won: | |

| Promo Cash Balance | ₹ 200 |

| Withdrawable Balance | ₹ 5000 |

| Entry Fee | ₹ 200 |

| Total Winnings | ₹ 1000 |

| Balance at Game Start | |

| Promo Cash Balance | ₹ 0 (₹ 200 is deducted to play the game) |

| Withdrawable Balance | ₹ 5000 |

| Updated balance on winning ₹ 1000* | |

| Promo Cash Balance | ₹ 0 |

| Withdrawable Balance | ₹ 5000 + ₹ 1000* = ₹ 6000 |

* ₹ 1000 = ₹ 800 Cash Winnings + ₹ 200 Entry Fee

Let's say Mr. Rao uses ₹ 200 from his Promo Cash balance to play games & loses.

| Case B: Game Lost | |

| Promo Cash Balance | ₹ 200 |

| Withdrawable Balance | ₹ 5000 |

| Entry Fee | ₹ 200 |

| Balance at Game Start | |

| Promo Cash Balance | ₹ 0 (₹ 200 is deducted to play the game) |

| Withdrawable Balance | ₹ 5000 |

| Balance after losing | |

| Promo Cash Balance | ₹ 0 |

| Withdrawable Balance | ₹ 5000 |

Note: On losing, there will be no change in the Withdrawable Balance

Scenario 2 (Points Rummy)

Let's say Mr. Rao plays a Points Rummy game of 1 Point Value & wins 20 Points

| Case A: Game Won: | |

| Promo Cash Balance | ₹ 200 |

| Withdrawable Balance | ₹ 5000 |

| Entry Fee | ₹ 80 (1 Point Value x ₹ 80) |

| Amount Won | ₹ 20 (1 Point Value x 20 Points Won) |

| Total Winnings | ₹ 100 (Entry Fee + Cash Winnings) |

| Balance at Game Start | |

| Promo Cash Balance | ₹ 120 (₹ 80 is deducted to play the game) |

| Withdrawable Balance | ₹ 5000 |

| Updated balance on winning ₹ 100 | |

| Promo Cash Balance | ₹ 120 + ₹ 80 (Entry Fee) = ₹ 200 |

| Withdrawable Balance | ₹ 5000 + ₹ 20 (Cash Winnings) = ₹ 5020 |

Note: On winning, ₹ 80 which was used as an Entry Fee will move back to the Promo Cash Balance. Cash Winnings of ₹ 20 will be added to Withdrawable Balance.

Let's say Mr. Rao plays a Points Rummy game of 1 Point Value & loses by 20 Points

| Case B: Game Lost: | |

| Promo Cash Balance | ₹ 200 |

| Withdrawable Balance | ₹ 5000 |

| Entry Fee | ₹ 80 (1 Point Value x ₹ 80) |

| Amount Lost | ₹ 20 (1 Point Value x 20 Points Won) |

| Balance at Game Start | |

| Promo Cash Balance | ₹ 120 |

| Withdrawable Balance | ₹ 5000 |

| Balance after losing | |

| Promo Cash Balance | ₹ 120 + ₹ 60 (₹ 80 - ₹ 20) = ₹ 180 |

| Withdrawable Balance | ₹ 5000 |

Note: On losing, players' Losing Amount (₹ 20) will be deducted from the Entry Fee (₹ 80). The balance amount (₹ 80 - ₹ 20 = ₹ 60), will get added back to Promo Cash.

Important

- Amount in the Promo Cash balance cannot be withdrawn.

- To play games, balance from Promo Cash balance will be used first, followed by Deposit & Withdrawable Balance

1 What is the new GST Rule?

As per the new GST rule passed by the Govt., 28% GST will apply on deposits on Online Gaming platforms from 1st Oct, 2023. Don’t worry✋You will get guaranteed Promo Cash on all deposits! Here’s how it will work -

Let's say you add ₹ 1000 on RummyTu.

GST Amount = 28% of Deposit Amount = ₹ 218.75 (28% of ₹ 781.25)

RummyTu will give you Promo Cash = (+ ₹ 218.75)

You can use the Promo Cash balance to enter Cash Games & Tournaments. Keep depositing worry-free!

2 Will I get my GST amount back?

No, the GST amount is collected from you on behalf of the government and cannot be refunded to you.

3 Where can I see my Promo Cash balance?

Click on the wallet icon and you will see 'Promo Cash' below Withdrawable Balance. Promo Cash, Instant Cash, Bonus, Reward Points & other Cash Offers are added here. Note - 'Promo Cash' is available only on the latest app version

4 Can I use my Promo Cash balance to play?

Yes, you can use your Promo Cash balance to play Cash Games & Tournaments

Note - Amount from your Promo Cash balance will be used first, followed by Deposit Balance & Withdrawable Balance.

5 Can I withdraw cash from my Promo Cash balance?

No, you cannot withdraw cash from your Promo Cash balance. But you can definitely use it to play & win real cash prizes!

Note - Cash winnings will get added to your Withdrawable Balance.

6 Will GST apply on my Withdrawal Balance?

No, GST will apply on the amount that you deposit.

7 Do I get a GST invoice?

Yes, you will get a GST invoice for all your deposits. You can download it from "My Transactions" >> 'Download Invoice >> Put a date range & 'Submit'

8 I have a GST number, can I get a discount?

As you are an individual and not a business entity, you cannot claim credit of GST paid.

9 Is GST applicable on every entry fee that I pay to enter a game table or is it applicable only at the time of depositing money to my account?

No, GST is not applicable on the entry fee used to enter a cash game or tournament. It is only applicable on the money that you deposit.

10 Do I still have to pay TDS?

Yes, 30% tax will be applied on Positive Net Winnings at the time of withdrawal or on 31st March (i.e. end of every Financial Year).